Copy trading is a methodology in which investors’ trade by automatically or manually copying another investor’s trades. In other words, Copy trading enables traders in the financial markets to automatically copy positions opened and managed by a selected investor, usually in the context of a social trading network. It is not very common in India but is very popular in US and UK. eToro is the most popular copy trading platform.

Copy trading is classified as investment management or portfolio where none of the manual input is evident from the account holder. Unlike mirror trading, copy trading is a method in which the traders copy only specific strategies; a link is created between the account of the copied investor and a portion of the copying trader’s fund.

According to the proportion of the copying trader’s allotted copy trading funds and the copied investor’s account, all trading actions made by the copied investor after that are carried out in the copying trader’s account. This includes assigning of Stop Loss and orders of Taking Profit, closing a position, or opening a position, etc.

The copying trader generally retains the ability to manage and disconnect copied trades. If needed they can also close the copy relationship altogether.

Also Read: Power of Compounding in Trading

Is copy trading safe?

It is like asking if driving a car on the road is safe! A better understanding of the market can be gained by copying other traders, and it has been observed that copy traders are repeatedly more profitable than people who just trade manually. But it is not much of help to those who are not participating in social trading, and just want to follow successful signal providers on copy trading platforms. Conviction is the key here, if you are copying someone’s trade but not fully convinced about it, eventually you will fall.

There were plenty of great traders on different platforms, who use to charge up 99% win rate for several times and had thousands of followers, who allocated more than US$25 million of funds following the path of such traders. All ended in a massive and sudden downfall – losing all their faithful followers. Overall when viewed from far, copy trading may seem not safe to a newcomer or beginner to the industry.

However, going back to the driving metaphor once again; we cannot blame cars for driving accidents, can we? This is because copy trading can be viewed just as an investment vehicle, like buying index funds or investing your money into the stock market. Copy trading can be as safe as it can get and as dangerous as your lack of knowledge regarding this industry and greed would allow.

How to be a successful Copy Trader?

While considering to start copy trading, The first and most important thing you can do will be to spend a lot of time in educating yourself about the basics of trading. The next step would be to understand the importance of money management and its role in the execution of technical strategy.

Once you learn more and more about copy trading, you would get to know how to analyze and evaluate the signal provider’s performance, how leverage can be properly used, and how a successful copy trading strategy can be built that would ensure sustainable profits over a long span of time.

It is effortless to generalize and make a blank statement about anything, but with the advantage of knowledge, you can beat the odds and turn copy trading into one of the most plausible passive income streams.

Also Read: Best Trading Softwares in India

Copy Trading in India

Copy Trading is not a very popular term in India, but its gradually gaining lime lights. Below are the two platforms through which you can start with copy trading at India:

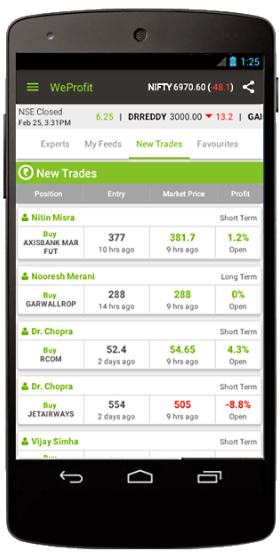

WeProfit (Discontinued)

Through WeProfit you can keep an eye on the portfolio of expert traders and investors. They offer a free mobile app where you get notifications for every trade idea with stop loss, target and time-frame. You can copy the trades you like or know each expert’s track record – winning trades, best trades, profit %, etc. Nooresh Merani and Karanam Vijay are few of the experts listed in WeProfit.

Open Trade

Open Trade is a copy trading platform from the house of famous discount broker Zerodha. Star traders from Zerodha client-base have been listed in Open Trade , and once you subscribe to this service you will get real-time notifications when they trade with all relevant details. Star traders are chosen based on their past track record and profitability. The subscription fee depends on the trader you would like to follow.

Note: Open Trade was officially shut down in 2018