Broadly, there are two methods to predict the behavior of stock prices; Technical Analysis and Fundamental Analysis. And this is the most controversial topic among investors and traders that which one of these two are better. Actually there is no discrete answer to this question, it all depends on your style of trading and conviction in your method. All the articles so far in this blog have been focused on technical analysis, but we would still try to do an unbiased comparison on Technical analysis vs Fundamental analysis.

What is Fundamental Analysis?

In layman terms, Fundamental analysis is the qualitative estimate of company’s worth based on its financial statements, future visions and cash flows. As an fundamental analyst, an investor puts his money into the company if it has strong fundamentals and huge potential to grow in the future. It also involves the analysis of companies’ revenues, earnings, assets, and liabilities. For ex: A steady increase in company’s QOQ earnings and guidance would make it fundamentally strong and attract many investors

What is Technical Analysis?

Contrary to Fundamental analysis, Technical analysts perform quantitative analysis of stock prices and volume to make buy/sell decisions. The primary assumption behind Technical analysis is the fact that price is always discounted on the charts irrespective of any news or events regarding the company. As a Technical analyst a person will study the chart of a stock with historical prices. He will try to identify price patterns to help him in predict the future move. Technical analysts believe that certain patterns always tend to repeat in the chart. They also study various technical indicators like Moving averages, RSI, MACD etc. For ex:- If 50 period moving average crosses 200 period moving average, then its called Golden Cross which is a strong bullish signal.

Technical Analysis vs Fundamental Analysis

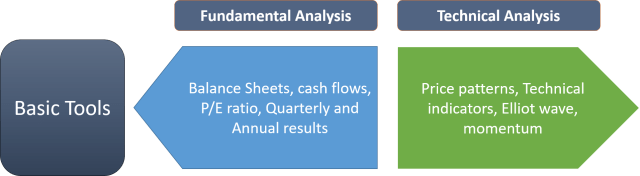

The below info-graphic shows a detailed comparison between Technical analysis vs Fundamental analysis:

Verdict

We always recommend Technical analysis to our readers as it is data driven, scientific and more realistic. Obviously it has flaws but that could be overcome with proper risk management and discipline. There are majority of people who still believe in fundamental analysis and heavily criticize technical analysts. We do not undermine them at all, as conviction in one’s methods is all it needs to be a successful trader. If you are a long term trader then combining technical and fundamental analysis can do the trick for you, you may look at fundamentals to select the stock and look at technical indicators to time your entry. All the modern day brokers and hedge funds have started using technical analysis to build their algorithmic trading systems. Also, their are many renowned certifications offered in the field of technical analysis. Check them out here.

As always, Please let us know your views in the comments section.

technical analysis can be used to identify multibaggers as well. Technicals helps to make 5x money in 2 to 3 years by identifying right stock at right time. Technical charts are reflections of fundamentals. I totally disagree that technical analysis can be used only for trading. Long term investing can be done by technical analysis.

Thanks for your perspective on this Likhit!