It’s not an exaggeration that compounding is called the 8th wonder of the world. The only way to become super rich in this world is to let your money grow. Withdrawing your returns every month from your bank account is no better than a fixed income job. People employ different methods to get compounded returns on their investment. Bank fixed deposit is one of the ways, it’s the safest means to multiply your money but the interest rate offered is too low. You may probably pass a generation to see your money actually working for you. Mutual funds SIP and equity investments are other options which offer better ROI.

In this article, we would explore how compounding can multiply one’s investment. For newbies- Compounding is a strategy where the returns earned is invested back into the same instrument. The interest or return earned during compounding is called ‘Compound Interest’. For Ex: if a person invests 100000 Rupees in an instrument which is offering a compound interest of 10% per annum, then his money will grow as per the below illustration:

| Year | Principal | Interest (10%) |

| 1 | 100000 | 10000 |

| 2 | 110000 | 11000 |

| 3 | 121000 | 12100 |

| 4 | 122100 | 12210 |

| 5 | 146410 | 14641 |

| 6 | 161051 | 16105.1 |

| 7 | 177156.1 | 17715.61 |

| 8 | 194871.7 | 19487.17 |

You can observe that the capital almost doubled in 8 years since it was allowed to compound. Here the compounding happened every year, i.e. the interest earned at the end of each year was invested along with principal next year. In real world, it’s not necessary that compounding should happen annually, it may happen monthly, weekly or even daily. The lesser the duration, more you would see the power of compounding. Below is the graphical illustration of the power of compounding. See how compounding varies with Interest Rate:

Traders can benefit immensely from compounding if they invest back their returns into the portfolio. And for a good trading system, you can expect more than 20% return each year. If this is allowed to grow, you can multiply your money in a very short period of time. However, risk management and position sizing is vital along with compounding for the long term growth of your wealth.

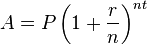

The following formula gives you the total amount one will get if compounding is done:-

- Where,

- A = Final Amount that will be received

- P = Principal Amount (i.e. initial investment)

- r = Annual nominal interest rate (as a decimal i.e. if interest is paid at 10% pa, then it will be 0.1) (it should not be in percentage)

- n = number of times the interest is compounded per year (i.e. for monthly compounding n will be 12, for half year compounding it will be 2 and for quarter it will be 4)

- t = number of years

Download our excel sheet to calculate compounding yourself.

good